It was time for the weekly Skype session with

Apurva and as promised I had to take her to the world where there is no concept

of Interest Rates. “How is it possible that the banks would lend out money but

would not charge interest on it, what is in it for banks then, how will they survive?”,

the questions came like bullets from the machine gun. “Islamic Banking is a

concept which works on the principal of Non-Interest”, I started explaining

her.

Islamic banks work on the Islamic principles

where it is not allowed to lend out money to others on interest. Does that mean

that banks lend out this money without any profit? No, obviously not!! Every entity

is required to generate profits for its survival and that is the prime reason

for its existence. But generating profit through interest is not the only way

of generating profit. Islamic banking also has profit generating mechanism but

it is devoid of the interest component and certainly not the compounding aspect

of it. To understand how Islamic Baking works, we need to first understand how

the regular commercialize banking with interest and compounding works. Let us say,

you want to buy a Tata Nano which costs Rs. 1, 00,000. You go to a Bank, say

RBM bank and ask for money. If the interest on the car-loan is 10%. At the end

of 2 years, you would have to payback Rs 1, 21,000([1, 00,000 *(1.1)]*(1.1)).

The fact that component of 1.1 (1+10%) appeared twice in the calculation is

because the interest gets compounded over the tenure of the loan which is two

years in this case. You will have to pay a total interest of Rs. 21000 at the

end of two years. Alternatively, RBM bank can give you option of making equal payment

based on the predefined frequency of payment which can be either Monthly, Semi-Annually

or Annually.

The above method of lending is based on

the principle of Risk Transferring. In the above case the ownership of the

Tata Nano car is with you till the time you make payment to the bank as decided

with the banks. In case you fail to make the payment, the bank will sell off the

car and keep the amount with it to recover the loss. This type of lending also

has inbuilt issue of money multiplication creating artificial money. Suppose

RBM bank lends you Rs. 100000 @10% for 1 year. You find a borrower which is

ready to pay interest of 12% but can’t finance his loan through bank due to

compliance issue. You decide to take the additional risk for getting 2% on Rs

100000 (i.e. 2000). The borrower who agreed to pay 12% to you finds another

borrower who is willing to pay 15%. Like you, he also lends money to him to get

3% on 100000 (i.e. 3000). Though the amount of money in the system is Rs. 1,

00,000 it has changed 3 hands causing money multiplication. The chain of risk transferring

will be shattered as soon the last hand in the chain defaults causing entire

chain to collapse. This principle of Risk Transferring was the prime reason was

2008 sub-prime crisis which we will discuss some other day. This is not possible

with Islamic banking because money is always lent for buying real assets such

as home, car, metal etc.

Unlike the commercial banking which works

on the principle of risk transferring, the Islamic banking works on the principle

of Risk Sharing. The Islamic banking allows charging the predefined fix profit

percentage which does not get compounded. There are different ways of lending under the Islamic

Banking that includes Istisna, Musawamah, Murabahah, Musharakah etc. I would

try to explain “Musharakah” which is the most used of all and how it is different

from the conventional banking. Suppose your father wants to buy a house in

which is worth Rs. 14, 00,000. He has Rs. 4, 00, 000 and needs financing of Rs.

10, 00,000.

Consider the case where your father

borrows it from conventional commercial bank which charges 10% interest

compounded annually. The repayment is to be done as 5 annual payments.

|

| Commercial_Bank_Loan_Repayment_Schedule |

The above diagram shows the calculations

for payments for Rs. 10, 00,000 loan from the commercial bank. As it can be seen that the yearly payment to

be made to the bank is constant every year. The principal to be paid as part of

that payment increases over the years while the interest component to be paid

reduces over the years as per the principal outstanding. Bank does not assume

any risk such as natural disaster and risk is entirely bared by the borrower.

In case of default, bank has the right to sell off the property and recover the

money.

Unlike commercial banks, Islamic banks

work on the principal of Diminishing Partnership in which share of the

bank reduces gradually till the time it is transferred to the borrower. It is

based on the principal of risk sharing which in turn corresponds to sharing of

profits or sharing of loss. As discussed it does not include interest and works

on the basis of fix, predefined profit rate. Islamic bank typically have both

internal and external Sharia compliance officer to ensure that the money is

lent in accordance with the Sharia principals (e.g. Lending money for alcohol,

arms is prohibited). The Islamic bank receives funds from the investors to lend

out to which bank gives the expected profit rate. The rate to the investors in

expected as it depends on the investment made by the bank to the customers in

terms of landings.

|

| Islamic_Banking_Repayment_Structure |

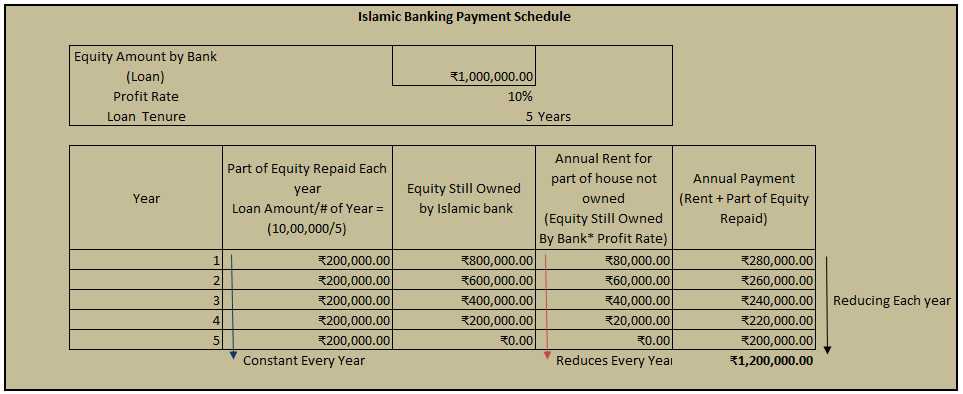

The above diagram shows the similar housing

loan and payment structure under the Islamic Banking. Borrower makes an yearly

payment to bank like that of the commercial banks but the yearly payment made

by the borrower reduces every year as with each passing year the borrower

increases the ownership stake in the property owned. The part of the annual

payment includes the equity payment made by the borrower to regain additional

ownership in the property and other part includes the profit paid to the Islamic

bank for the equity still owned by the bank). In case of natural disaster or

any other issue the borrower forgoes only the part of the equity owned by him

and banks bares the risk for part of owned by it. The borrower can sell off his

ownership to other borrower who will then continue the payments to the Islamic

bank.

“I now understand how Islamic Banking works!!

On face of it looks like a better model of lending. I wonder what will happen

when it will gain more popularity and entire world will work on the non interest

principal”, said Apurva. “There is still long way to go for that, “Musharakah”

that we discussed is just part of Islamic banking. We would cover the other

parts sometime later.” we ended the Skype call on that note.

No comments:

Post a Comment