Calculating Inflation and its relation with the Currency

It had

been a month since I joined IIM Kashipur to pursue my MBA and I was loving this

place already. Hostel life was a completely new experience for me. The fact

that tourist attractions like Jim Corbett Park, hill station of Nainital are an

hour away from the institute was fascinating. This was the first time I had

moved out of Mumbai, away from my family, but technologies such as Skype helped

me to break the geographical barriers to great extent. It was time for me to keep my promise on the

deal that I had struck with Apurva and have the weekly Skype session to answer

her questions. After the discussion about my life at IIM Kashipur, we started

the discussion where we had left.

“Before

you tell me the relation between the currency and the inflation, I have been

wondering all this while as to how RBI calculates the inflation and concludes

whether it is high or low ?”,asked Apurva.

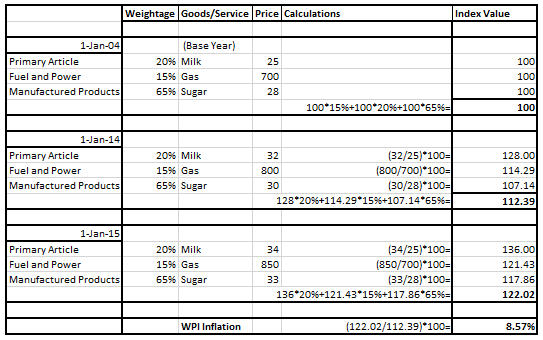

“RBI

uses an Index called as Wholesale Price Index (WPI) to calculate inflation”, I

started explaining her. It is an index build with the prices the wholesalers

have to pay to the manufacturer. This index is an indicative figure whose value

can be compared with previous time period such as previous month or previous

year. In WPI there are more than 650 goods and commodities whose wholesale price is

tracked. These commodities are divided in three main categories which are

1.

Primary Articles 2. Fuel and Power 3.

Manufactured Products.

These

three categories are given weight as per their influence in day to day life

of a common Indian Man. Primary Articles are given 20% weight while Fuel and Power

are given 15% and Manufactured Products are given 65% weight. Each of these

categories have many items with the weight distributed among the category. And

as with every index there is a base year whose value is considered to be 100

and new value of index would be calculated based on the base year value. For

WPI year 2004 is considered to be base year with the value of 100. Let me

explain this with the help of an example. For simplicity, assume there are only

three items that existed: Milk, Oil and Sugar.

|

| WPI_Calculation_Simplified |

So as

per the calculation the WPI inflation is 8.57%. The WPI inflation number is

available weekly every Thursday with two weeks of delay. WPI is the main index

which is followed by RBI as to decide whether the inflation is in control or

not. Apart from WPI, RBI also looks for a Consumer Price Index (CPI) which is a

price index calculated based on the prices which end consumers pay to the

retailers. This index indicates actual inflation in the hands of consumer and

not just for the wholesalers.

“RBI

would want WPI inflation to be 0% or even negative, right?” asked curious

Apurva. “Not really”, I started explaining her. RBI would want this to be

around 3-4% ideally on the consistent basis. RBI also needs to keep a check on

the CPI along with WPI. If inflation is 0% then the total output would not grow

and working population would not get their promotions and salary hike. We

cannot allow the inflation to go beyond a particular bracket because the salary

hikes are not consistent for all, i.e. Income is not uniformly distributed

while the increased expenditure is! The rich people of the society can afford

the inflation but poor people will not be able to afford it as their income

levels have not increased compare to increase in the inflation.

“Now

that I understand how inflation is calculated can you please tell why the

change in the currency would lead to inflation? I mean, why would change in the

currency value would increase the price of the goods and commodities?

“It

would be unfair to say that the price of the commodities and goods change if

there is a change in the currency but it certainly impacts the inflation”. Let us take an example,Suppose on 1st of

January 2014, 1$= ₹50. Suppose you want to order an iPhone 6 plus from USA

since it has yet not been launched in India.Assume that an iPhone 6 plus costs $1000. The

US retailer selling the iPhone to you would prefer the payment in $ as USA has

currency of $. So you have to pay ₹ 50000

typically to a Bank or an institution which is into the currency exchange

business and buy $1000 and buy the iPhone 6 plus. 2 days after the purchase on

3rd of January 2014, you show this iPhone to your best friend and

now she also wants a similar phone but on 3rd of Jan 1$= ₹ 60. The iPhone

price is still $1000 but now to buy $1000 you have to give ₹ 60000. Even though

the price of iPhone stayed $1000 you still experienced inflation. This is

because the purchasing power of Indian Currency has reduced. That is why when the 1$ value changes from ₹ 50 to ₹ 60 we say that Indian Rupees has depreciated

as the currency cannot buy as much as it could earlier and we say that $ has

appreciated because it take more Rupees to purchase similar amount of $.

“I now

understand the how inflation is calculated and relationship between the

currency and inflation but why does the value of 1$ change?” asked Apurva.

"There are many factors that govern the movement of the currency, let us

discuss them next time,when we have the Skype session”, I told her. It was already

11.30 in night but like all others studying in IIM, day had just begun, I

thought.